具体描述

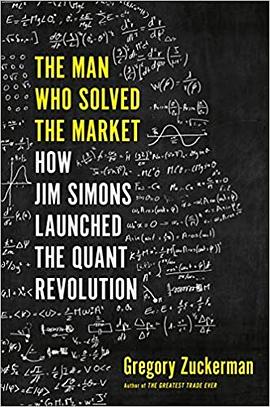

Bestselling author and veteran Wall Street Journal reporter Gregory Zuckerman answers the question investors have been asking for decades: How did Jim Simons do it?

Jim Simons is the greatest money maker in modern financial history. His track record bests those of legendary investors including Warren Buffett, Peter Lynch, Ray Dalio, and George Soros. Yet Simons and his strategies are shrouded in mystery. Wall Street insiders have long craved a view into Simons's singular mind, as well as the definitive account of how his secretive hedge fund, Renaissance Technologies, came to dominate financial markets. Bestselling author and Wall Street Journal reporter Gregory Zuckerman delivers the goods.

After a legendary career as a mathematician at MIT and Harvard, and a stint breaking Soviet code for the U.S. government, Simons set out to conquer financial markets with a radical approach. He hired mathematicians, physicists, and computer scientists, most of whom knew little about finance. Experts scoffed as Simons built Renaissance Technologies from a dreary Long Island strip mall. He amassed piles of data and developed algorithms to hunt for deeply hidden patterns in the numbers--patterns that reveal rules governing all markets.

Simons and his colleagues became some of the richest individuals in the world and their data-driven approach launched a quantitative revolution on Wall Street. They also anticipated dramatic shifts in society. Eventually, governments, sports teams, hospitals, and businesses in almost every industry embraced Simons's methods.

Simons and his team used their newfound wealth to upend society. Simons has become a major influence in scientific research, education, and politics, while senior executive Robert Mercer is more responsible than anyone else for Donald Trump's victorious presidential campaign. The Renaissance team's models didn't prepare executives for the ensuing backlash.

The Man Who Solved the Market is the dramatic story of how Jim Simons and a group of unlikely mathematicians remade Wall Street and transformed the world.

用户评价

##“Simons could be remembered for what he did with his fortune, as well as how he made it.”

评分##COVID read

评分##19#15 (又一本)曾经求翻而未得的书。略有失望,但仍然有趣,结尾稍弱,整体只能算是中规中矩。Simmons虽然招募了一支才华横溢的科学家团队,“launch”了量化革命,但严格地“the man who solved the market”的标题有标题党之嫌。与LTCM之间的对比很有趣。但大奖章仍然是那个神秘的大奖章,中间几个章节充斥着“进一步改进了算法”、“效果拔群”之类的描述,但干货太少。作为2019年最后一本书(highly likely),希望自己明年也能solve一些东西吧。

评分##大奖章作为人类历史上投资回报最高的基金,其在宽客心中如上帝般高高在上。此书带给我的最大震撼,是宽客之神西蒙斯的三次非量化之举。海湾战争爆发,他推倒系统,买入石油看涨期权对冲风险并减仓1/3;纳指泡沫时西蒙斯在危机面前迅速放弃经仔细研判后认定为明显错误的动量信号,减少损失;在金融危机前夕他不顾其他人的阻挠,声称“我们的任务是活下来,即使我们错了,后面还可以加仓”,快速削减仓位,西蒙斯认为20个标准差外的事件必须以非常手段来对待,结果错过了逆势加仓的好机会。最近的18年底西蒙斯还给自己的信托基金致电要求做空部分仓位以对冲风险。西蒙斯这类不惜牺牲对系统决策的信仰而寻求自保的态度也促使他在89年救基金于水火,快速撤离,避免了自己的券商倒闭,期权过期的窘境--当你嗅到烟味,就赶紧他妈的逃!

评分##痛读两天搞定。虽然只是传记,但还是了解到很多的,周末有空时写心得。

评分##痛读两天搞定。虽然只是传记,但还是了解到很多的,周末有空时写心得。

评分##没啥大意思

评分##大奖章作为人类历史上投资回报最高的基金,其在宽客心中如上帝般高高在上。此书带给我的最大震撼,是宽客之神西蒙斯的三次非量化之举。海湾战争爆发,他推倒系统,买入石油看涨期权对冲风险并减仓1/3;纳指泡沫时西蒙斯在危机面前迅速放弃经仔细研判后认定为明显错误的动量信号,减少损失;在金融危机前夕他不顾其他人的阻挠,声称“我们的任务是活下来,即使我们错了,后面还可以加仓”,快速削减仓位,西蒙斯认为20个标准差外的事件必须以非常手段来对待,结果错过了逆势加仓的好机会。最近的18年底西蒙斯还给自己的信托基金致电要求做空部分仓位以对冲风险。西蒙斯这类不惜牺牲对系统决策的信仰而寻求自保的态度也促使他在89年救基金于水火,快速撤离,避免了自己的券商倒闭,期权过期的窘境--当你嗅到烟味,就赶紧他妈的逃!

评分##一本全面的介绍,Jim Simons早期作为一名天才的数学家获得了成功,后来他成功破解了苏联的通讯密码,并以文艺复兴科技公司为代表在金融投资界掀起了一场革命。通过使用海量数据、算法和计算,他改变了全球金融的运作方式。在积累了巨大的财富之后,他现在是众多组织和进步倡议的有力资助者。https://mp.weixin.qq.com/s/lgRbyYyMCc1SgzX7ElJWwQ

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2026 book.teaonline.club All Rights Reserved. 图书大百科 版权所有